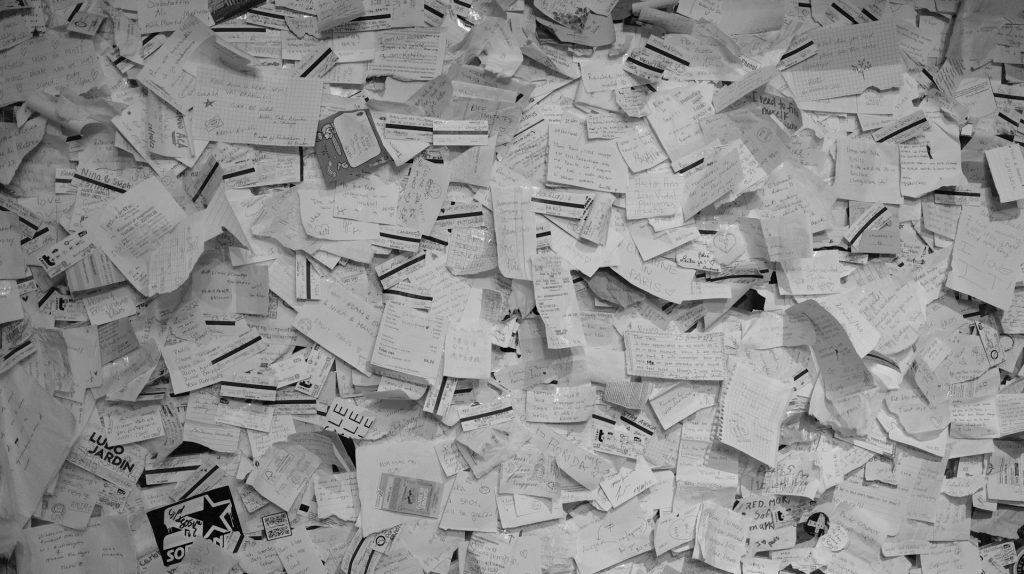

If your desk looks like a library explosion every tax season, this post is for you. A tidy paperwork system saves time, protects your privacy, and makes audits less stressful. The goal isn’t to become a paper minimalist overnight, but to set up a straightforward rhythm: decide what to keep, securely dispose of what you don’t, and digitize receipts so nothing slides into chaos.

Title: Shred, Recycle, and Relax: A Simple Guide to Tidy Paperwork

The core idea for today’s hour: shred, recycle, and organize with a purpose

- Shred: anything that contains sensitive personal or financial data (SSN, bank accounts, passwords, etc.).

- Recycle: what isn’t sensitive and can’t impact your finances or legal obligations.

- Organize: what you need to keep for audits, taxes, warranties, and compliance.

- Digitize where possible: scan documents you need to keep and store them securely.

What to avoid

- Don’t keep everything “just in case.” Most documents have a practical retention window. Holding on indefinitely creates clutter and risk.

- Don’t mix sensitive papers with general recycling. A pile of unshredded papers can expose you to identity theft and data breaches.

- Don’t staple and binder-clip everything into one giant folder. It makes shredding and scanning harder, and important items can get buried.

- Don’t rely on memory or scattered notes for audit-related items. If it’s needed for legal or tax purposes, store it in a labeled, retrievable place.

- Don’t ignore digital privacy bits. Even digital receipts can contain sensitive information; plan how you store and delete digital copies too.

What to keep for auditing

Audits (tax, legal, or financial) typically require documentation that proves your numbers and decisions. A practical rule of thumb is to keep supporting documents for a reasonable window and then consolidate into a retention plan. When in doubt, consult a CPA or your legal advisor.

Common categories to retain

- Tax returns and supporting documents (receipts, invoices, mileage logs): keep at least 7 years. This aligns with many tax professionals’ guidance and can help if the IRS questions past filings.

- Invoices and financial records (vendor invoices, receipts for business expenses): keep 7 years.

- Bank statements and reconciliations: keep 7 years.

- Contracts and legal documents: keep the life of the contract plus 7 years.

- Payroll records and wage statements: keep a minimum of 7 years.

- Insurance policies and claim records: keep through the policy period plus about 6 years.

- Asset purchase, depreciation, and title documents: keep for as long as you own the asset, plus 7 years after disposition.

- Warranties and product manuals related to business assets: keep for as long as you own the item or as long as the warranty lasts.

Retention needs can vary by business type, state requirements, and specific tax rules. If you’re unsure, a quick consult with a CPA can set a precise schedule tailored to you.